Exploring The Best International Bank Accounts World Travel

Estimated Reading Time: 6 Minutes Embarking on international adventures, whether for business or pleasure, requires careful financial planning. In this guide, we'll explore four top-notch international bank accounts and corresponding debit cards: Wise, Revolut, BNP Paribas, and HSBC. From innovative fintech solutions to trusted traditional banks, each option offers unique benefits for global travelers. Let's delve into the world of international banking and uncover how to make the most of multicurrency accounts.

Key Takeaways (TL;DR):

- Wise (Non-Traditional)

- Revolut (Non-Traditional)

- BNP Paribas (Traditional)

- HSBC (Traditional)

These banks and services cater to different needs, from low-cost digital solutions to extensive traditional banking services, ensuring travelers can manage their finances effectively wherever they go.

Wise: Pioneering Global Finance

Wise, formerly known as TransferWise, is leading the charge in revolutionizing international banking. Here's why it's a must-have for savvy travelers:

Non-Traditional Approach - Wise operates on a peer-to-peer model, slashing fees and offering competitive exchange rates for international transfers.

Multi-Currency Account - With Wise, you can hold and manage money in over 50 currencies, simplifying transactions across borders.

Debit Card - Wise's debit card allows you to spend money abroad at the real exchange rate, without hidden fees or markups.

Borderless Account - Wise's borderless account lets you receive money in multiple currencies, making it ideal for freelancers, digital nomads, and businesses with global clients.

Optimal use

Utilize Wise for seamless international transactions, whether you're paying for accommodations, receiving payments from clients overseas, or simply managing your finances across borders. With transparent fees and real exchange rates, Wise ensures you get the most out of your money wherever you go.

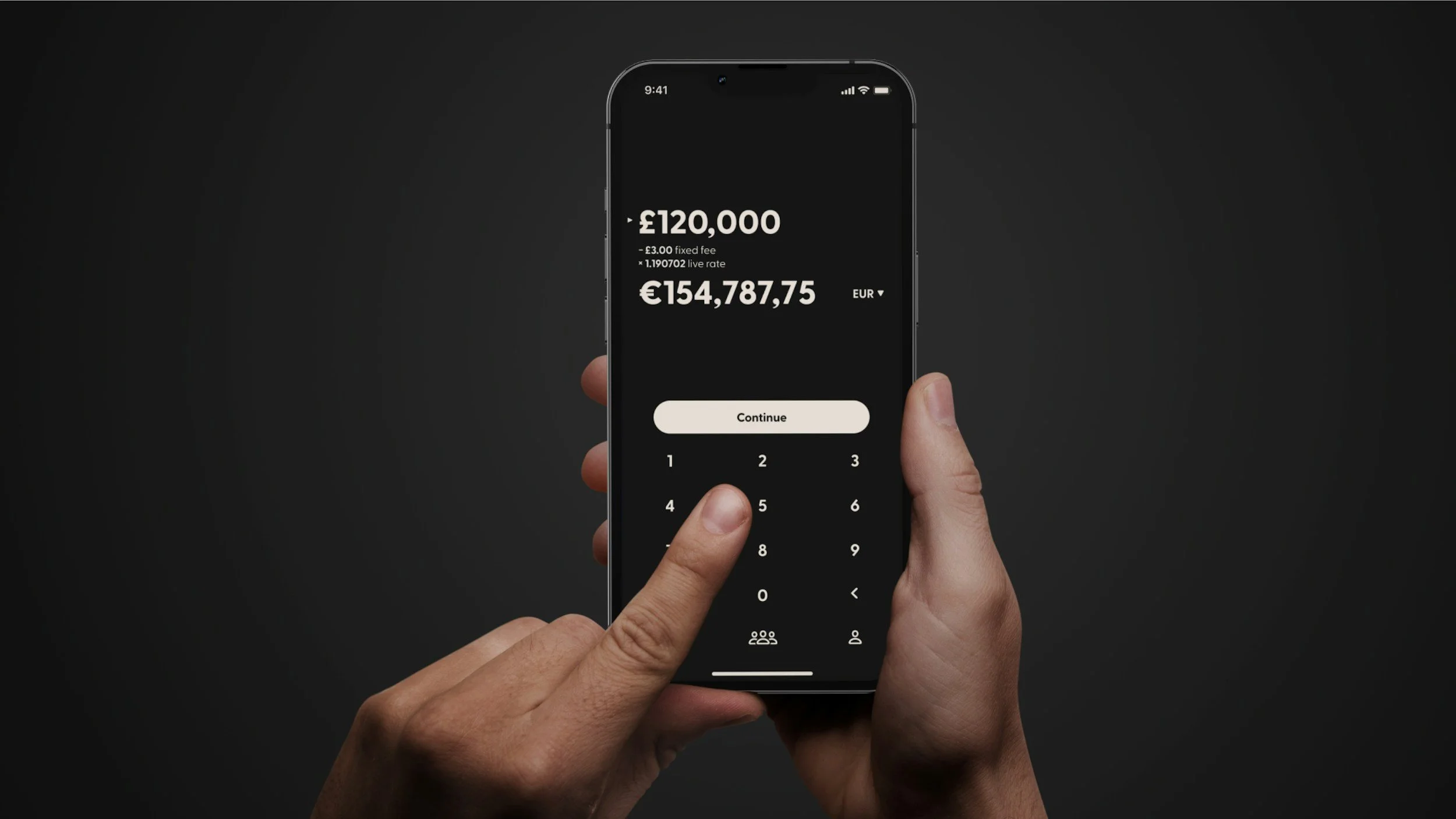

Revolut: Empowering Global Finances

Revolut is another trailblazer in the world of international banking, offering innovative features tailored for travelers and businesses alike. Here's what sets it apart:

Non-Traditional Approach: Revolut leverages technology to provide fast, affordable, and transparent financial services, including currency exchange, money transfers, and spending abroad.

Multi-Currency Account: With Revolut, you can hold and exchange 28 currencies at interbank rates, with no hidden fees.

Debit Card: Revolut's debit card allows you to spend in over 150 currencies at the interbank exchange rate, with no fees for overseas spending.

Business Solutions: Revolut Business offers a suite of tools for managing international payments, expenses, and invoices, making it ideal for entrepreneurs and small businesses with global aspirations.

Optimal Use

Make the most of Revolut's features by using its multi-currency account and debit card for all your international transactions. Whether you're traveling for leisure or conducting business abroad, Revolut's transparent pricing and convenient app make managing your finances a breeze.

BNP Paribas: A Global Banking Powerhouse

BNP Paribas is a traditional banking institution with a global footprint, catering to the diverse needs of individuals and businesses worldwide. Here's why it's a top choice for international banking:

Established Reputation - With over 200 years of experience, BNP Paribas is one of the largest and most trusted banks in the world, providing stability and reliability for its customers.

International Network - BNP Paribas boasts a vast network of branches and ATMs across multiple continents, ensuring seamless access to your funds wherever you travel.

Multi-Currency Support - BNP Paribas offers multi-currency accounts and services, allowing you to transact in different currencies with ease.

Business Solutions - BNP Paribas provides comprehensive banking solutions for businesses of all sizes, including cash management, trade finance, and international payments.

Optimal Use

Tap into BNP Paribas's global network and expertise to manage your international finances with confidence. Whether you're traveling for leisure or expanding your business overseas, BNP Paribas offers a range of services to meet your needs, backed by a legacy of trust and reliability.

HSBC: A Trusted Name in Global Banking

HSBC is synonymous with international banking, serving millions of customers around the world with its comprehensive range of financial services. Here's why it's a powerhouse in the global banking arena:

Established Presence - With a presence in over 60 countries and territories, HSBC offers unparalleled access to international markets and financial expertise.

Multi-Currency Accounts - HSBC's multi-currency accounts allow you to hold and manage funds in multiple currencies, making it convenient for international travel and business transactions.

Global Services - HSBC provides a wide range of banking services, including personal banking, wealth management, and corporate banking solutions, tailored to the needs of global citizens and businesses.

Premier Banking - HSBC Premier offers exclusive benefits and privileges for high-net-worth individuals, including personalized banking services, priority support, and global recognition.

Optimal Use

Leverage HSBC's global network and diverse range of services to optimize your international banking experience. Whether you're a frequent traveler, an expatriate, or a multinational corporation, HSBC's expertise and global reach ensure that your financial needs are met wherever you are in the world.

Our Picks

Non-Traditional: Wise

Wise's innovative approach to international banking makes it a standout choice for both personal and business travel. Whether you're sending money to family overseas, paying for accommodations in another country, or managing expenses for your business, Wise offers convenience, transparency, and cost-effectiveness.

Traditional: BNP

For those who value the security and reliability of a traditional banking institution, BNP Paribas delivers. Whether you're a frequent traveler or a business owner with international operations, BNP Paribas provides the tools and support you need to manage your finances with confidence.

Final Thoughts

Choosing the best international bank account and debit card can streamline your travel experience and facilitate seamless financial transactions across borders. Whether you opt for the innovative solutions of Wise and Revolut or the trusted services of BNP Paribas and HSBC, multicurrency accounts offer unparalleled flexibility and convenience for personal and business travelers alike. By understanding the benefits of international banking and leveraging multicurrency accounts effectively, you can navigate the global financial landscape with ease and confidence.

When it comes to international banking, having the right account and debit card can streamline your travel experience and simplify your financial transactions. Whether you prefer the modern convenience of Wise or the trusted reputation of BNP Paribas, there's a solution tailored to your needs. By choosing the best international bank account for your personal or business travel, you can enjoy peace of mind knowing that your finances are in good hands, no matter where in the world you may be.

Mexico is a country that enchants visitors with its vibrant culture, rich history, and stunning natural beauty. From the bustling streets of Mexico City to the serene beaches of Cancun, Mexico offers a diverse range of experiences for every traveler. In this blog post, we'll explore why Mexico is an appealing travel destination, highlighting its key cities and regions.